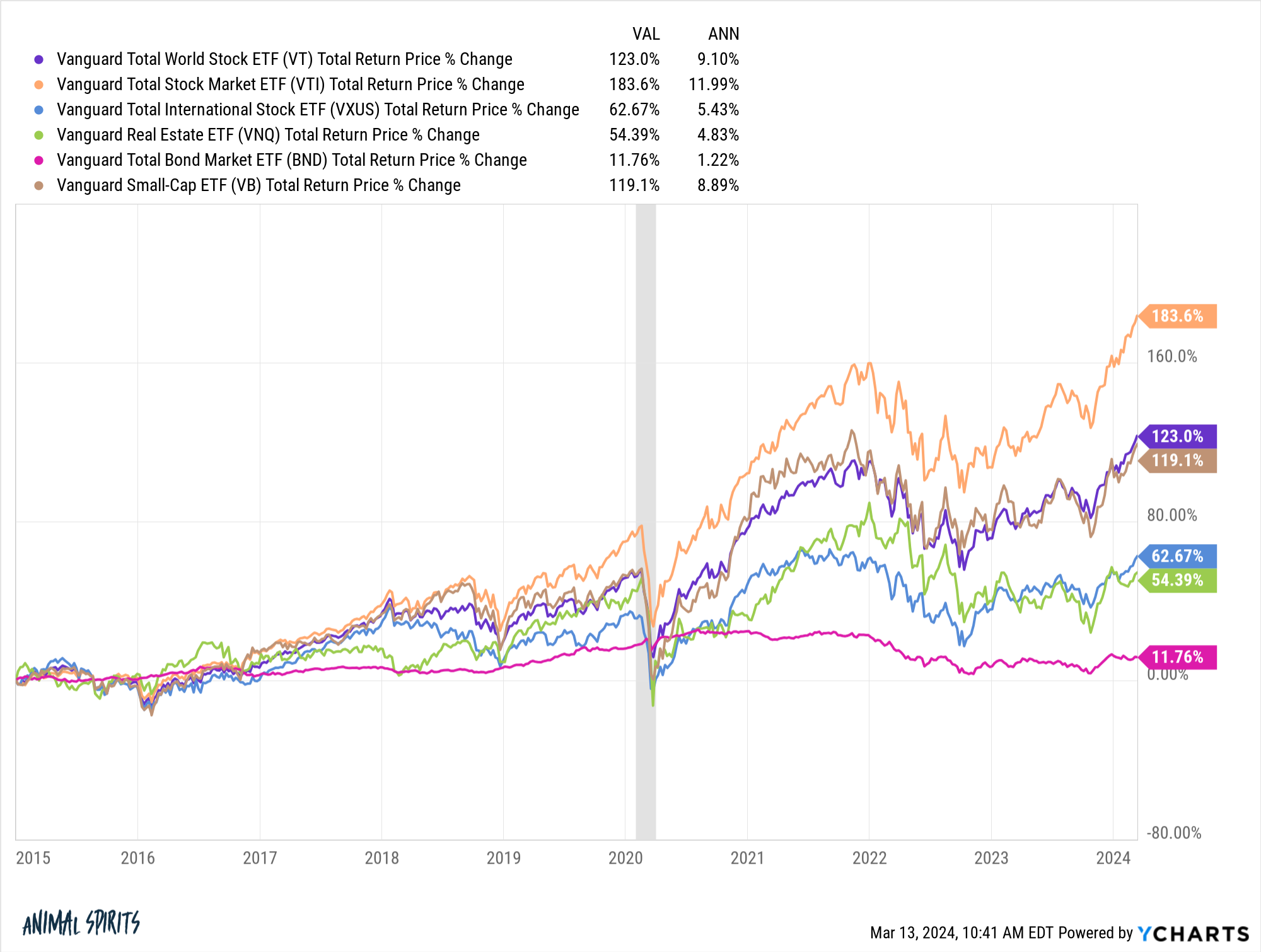

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Memes To Text Your Friends

- Reditt Nsfw

- Arrowhead Stadium Temp

- Nfl Preseason Defense Rankings

- Indeed Jobs Walhalla Sc

- Ai Undress

- High Paying Jobs No Experience

- Partner Mike Rowe

- Men Tattoo

- Pensacola Police Department Number

- Ewu Insider

- Terraria Class Guide

- Fatal Car Crash Sacramento

- Att Login Bill Pay

- Buzzfeed Food Quiz

Trending Keywords

Recent Search

- Power Outages San Francisco

- Mediacom Cable Outages

- Kelly Ripa And Son

- Is Front Row Amy Divorced

- Lyrics I Can T

- Zillow Oconee County Sc

- 247 North Carolina

- Trib Basketball Scores

- Giant Groceries

- Providers Ushealth Group

- Nyu Langone Health Jobs

- Verizon Fios Down In My Area

- Shop Cracker Barrel Online

- Job At Home Depot Near Me

- Finger Lakes Times

_14.jpg)